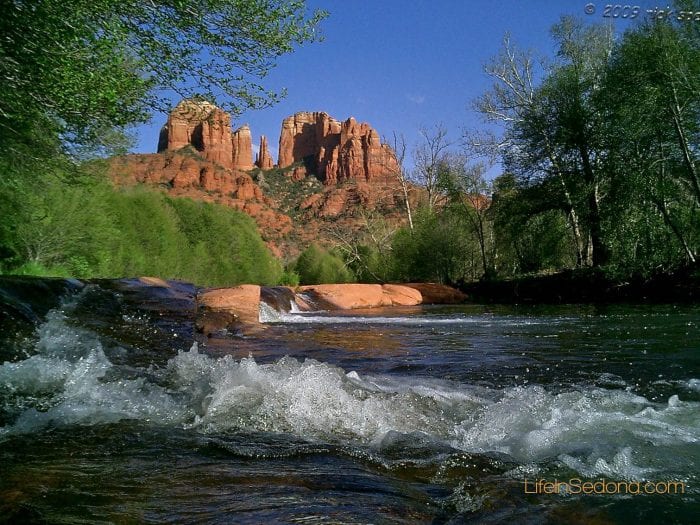

Your New Sedona Home

Your New Sedona Home

Once you are in your new Sedona home, light fixtures will be on your list to make your statement. It’s not just about wattage anymore. Light fixtures and light bulbs come in myriad types, sizes and colors. Do you want LED? Should you use “soft” bulbs? And what is the difference between watts and lumens? With the phase-out of the traditional incandescent bulb, the lighting choices you grew up with are not the same as what will be available in the future.

When making choices for your new home, consider the light’s expected usage, the use of the room and the availability of replacement bulbs.

How Light Works

Artificial light affects how color appears on your walls and ceilings. That is why paint colors that seemed so perfect at the paint store can look all wrong on your walls. Some popular bulbs for home use will change how color appears, and how a room “feels” when the lights are on.

- Incandescent bulbs. The bulbs we grew up with typically have a warm cast and brighten up colors in the warmer spectrums (reds, oranges, yellows) and dampen colors in the cool spectrum. However, as of this year (2014) most incandescent bulbs will be phased out for general use. Although there are exceptions for specialty bulbs, including some sizes of the very popular designer Edison bulb, when your bulb goes, you’ll need to replace it with some form of fluorescent or halogen bulb. Or, you’ll need a new light fixture altogether.

- Standard fluorescent bulbs. The long tubes used in schools, retail stores and offices emit cooler colors that enhance greens, blues and purples while subduing reds, oranges and yellows. These bulbs often “hum” in the background. Better for work areas (kitchen, garage), standard fluorescents offer an economical lighting source.

- CFLs. Compact fluorescents are the obvious choice to replace incandescent bulbs. With bayonets that fit most light fixtures, CFLs are available in a variety of sizes, shapes and wattages. They also have a Kelvin rating which determines the color spectrum of the bulb. The lower the Kelvin number, the warmer the colors. A “full spectrum bulb” is designed to mimic daylight.

- LEDs. Light-emitting diodes emit a warmer light. Often the “bulb” has a reflective cone that augments the light. LED light enhances most paint colors and gives natural lighting that works well for bathrooms and dressing areas.

- Halogen. Because of their whiter, brighter light and longevity theater stages use halogen lights for high performance applications. In the home, halogens reduce eyestrain as reading lights, offer safety and security to your outdoors and highlight your artwork. They burn hotter than other lights, though, so don’t belong in areas where the bulb can’t be shielded. Some older halogen fixtures—especially torchiere lamps—posed a fire hazard from the hot-burning bulb, so check to make sure your halogen fixtures have protective shields.

Replacing Fixtures

When replacing light fixtures, consult a lighting designer to solve lighting challenges and create the most economical arrangement of your lighting profile.

We can help you determine the best lighting upgrades for the sale of your home. Give us a call to set up an appointment for a home review today.

Compliments of Virtual Results

Your New Sedona Home

Your New Sedona Home According to

According to  Light exposure in your room plays a large part in the visual drama of your paint colors. In rooms with multi-directional sun exposure—either opposing (east/west or north/south) or perpendicular (north/west, north/east, south/west, south/east)—the play of light over your walls, reflecting off your ceiling or bouncing off the floor can change the appearance of the paint colors your chosen. In fact, the colors will look different at various times of the day and even change with the seasons throughout the year. And, when you add artificial light into the mix you may end up with a look you weren’t expecting.

Light exposure in your room plays a large part in the visual drama of your paint colors. In rooms with multi-directional sun exposure—either opposing (east/west or north/south) or perpendicular (north/west, north/east, south/west, south/east)—the play of light over your walls, reflecting off your ceiling or bouncing off the floor can change the appearance of the paint colors your chosen. In fact, the colors will look different at various times of the day and even change with the seasons throughout the year. And, when you add artificial light into the mix you may end up with a look you weren’t expecting. While home prices are on the rise in most of the U.S.—fueled by the low supply, low mortgage rates and investor buying—the number of Americans that own homes, as a percentage of the population, is decreasing. The reasons vary, since many current renters are former homeowners that lost their homes during the financial crisis and others simply do not have enough income to qualify. But some potential homeowners, with savings for down payments and the desire to own may be priced out of the market by as little as $1000.

While home prices are on the rise in most of the U.S.—fueled by the low supply, low mortgage rates and investor buying—the number of Americans that own homes, as a percentage of the population, is decreasing. The reasons vary, since many current renters are former homeowners that lost their homes during the financial crisis and others simply do not have enough income to qualify. But some potential homeowners, with savings for down payments and the desire to own may be priced out of the market by as little as $1000. Low housing supply is causing prices to rise for rentals for West Sedona Rental property. If you are looking for income property, I can help you determine the right property for you.

Low housing supply is causing prices to rise for rentals for West Sedona Rental property. If you are looking for income property, I can help you determine the right property for you. How to sell Sedona Real Estate for full price means establishing the right price at the outset.

How to sell Sedona Real Estate for full price means establishing the right price at the outset.

When you are cleaning to sell your Sedona home, buyers notice. This can be the easiest way to add value to your home. A well cared for home goes a long way with a buyer and their perception of the home they are looking to buy. At

When you are cleaning to sell your Sedona home, buyers notice. This can be the easiest way to add value to your home. A well cared for home goes a long way with a buyer and their perception of the home they are looking to buy. At  When you’re in a hurry to sell, you need top dollar, try some of these tips:

When you’re in a hurry to sell, you need top dollar, try some of these tips: Whether you’re preparing your home to move in, or preparing it to sell, choosing the right paint from the myriad choices available to day can be daunting. Paints come in up to six different finishes, so even if you’ve chosen the colors, you still have to decide on the finish for your application.

Whether you’re preparing your home to move in, or preparing it to sell, choosing the right paint from the myriad choices available to day can be daunting. Paints come in up to six different finishes, so even if you’ve chosen the colors, you still have to decide on the finish for your application. Lush greens and rolling verdant fairways stoke homeowner dreams of the perfect lawn. This holds true in Sedona as in most areas. Though, many homes have desert landscaping in the front and backyard, so a green lawn can be very novel in Sedona and other desert areas such as Phoenix and Tucson. For most areas, July starts the season with the highest demand on the water supply. So maintaining those lavish landscapes takes knowledge and a plan. In Sedona, our two driest months are May and June. Monsoon helps to eleviate the burden of water consumption in our desert areas.

Lush greens and rolling verdant fairways stoke homeowner dreams of the perfect lawn. This holds true in Sedona as in most areas. Though, many homes have desert landscaping in the front and backyard, so a green lawn can be very novel in Sedona and other desert areas such as Phoenix and Tucson. For most areas, July starts the season with the highest demand on the water supply. So maintaining those lavish landscapes takes knowledge and a plan. In Sedona, our two driest months are May and June. Monsoon helps to eleviate the burden of water consumption in our desert areas. For many people, your home is your largest asset. Like your parents, and grandparents before them, you expect your home—in some way—to fund your retirement. For some of you, that means selling the home near retirement and relocating, using the funds to purchase a smaller home with money left over to live on. For others, you plan to live in your paid-off home until you die. Some of you aren’t sure how it all works; you just know that home ownership is supposed to be a great investment.

For many people, your home is your largest asset. Like your parents, and grandparents before them, you expect your home—in some way—to fund your retirement. For some of you, that means selling the home near retirement and relocating, using the funds to purchase a smaller home with money left over to live on. For others, you plan to live in your paid-off home until you die. Some of you aren’t sure how it all works; you just know that home ownership is supposed to be a great investment. Okay, so it’s not the Titanic. It’s your new house and you can’t seem to make your older furniture fit. Buying new furniture is out of the question, so how do you make your round pegs fit into those square holes?

Okay, so it’s not the Titanic. It’s your new house and you can’t seem to make your older furniture fit. Buying new furniture is out of the question, so how do you make your round pegs fit into those square holes?

If you already own that select property here in Sedona, you may think that a lot of these topics do not apply to you. On June 15th, we enter the monsoon season in Arizona and though Sedona does not always get the brunt of the storms, we can get micro bursts where the heavens open up and the rain pours very hard for a short time. Flash flooding is possible so we want you to be prepared. You can go to

If you already own that select property here in Sedona, you may think that a lot of these topics do not apply to you. On June 15th, we enter the monsoon season in Arizona and though Sedona does not always get the brunt of the storms, we can get micro bursts where the heavens open up and the rain pours very hard for a short time. Flash flooding is possible so we want you to be prepared. You can go to  If you’ve lived in your home for some time, you notice when the neighborhood around you is changing to a younger demographic. Thinking this might be a good time to sell, you wonder what was so appealing about the house down the street to the young couple that just moved in.

If you’ve lived in your home for some time, you notice when the neighborhood around you is changing to a younger demographic. Thinking this might be a good time to sell, you wonder what was so appealing about the house down the street to the young couple that just moved in. In a new home or neighborhood, preparing for emergencies in advance might just save you or your family member’s life. In Part 2, we cover the basics for inside your house.

In a new home or neighborhood, preparing for emergencies in advance might just save you or your family member’s life. In Part 2, we cover the basics for inside your house. Keeping your home comfortable and up-to-date seems like an expensive endeavor. With trends changing so fast, our wallets can hardly keep up! Lucky for us, Memorial Day is just around the corner. If you shop smart at the sales this holiday you can give your home the facelift you desire.

Keeping your home comfortable and up-to-date seems like an expensive endeavor. With trends changing so fast, our wallets can hardly keep up! Lucky for us, Memorial Day is just around the corner. If you shop smart at the sales this holiday you can give your home the facelift you desire. When you move into your new home, you may not think to revise and update your emergency plan, but natural disasters strike without warning. Avoid being caught without a plan in place at your new address. Here are ten steps to take to make sure you are ready the day you move in and continue staying prepared to keep your family safe.

When you move into your new home, you may not think to revise and update your emergency plan, but natural disasters strike without warning. Avoid being caught without a plan in place at your new address. Here are ten steps to take to make sure you are ready the day you move in and continue staying prepared to keep your family safe.